RBI Repo Rate 2023 Hike, History, Graph & Chart

The Union Budget will be placed before the parliament by our Finance Minister, Shrimati Nirmala Sitharaman. The event will begin with a speech at 11 in the Rashtrapati Bhavan on 1st Feb 2023. The people are looking forward to the forthcoming budget and have high hopes as well. There will be many big announcements depending on the budget planned for the nation. Read and know now about the RBI Repo Rate Hike; history, Graph & Chart and other details are provided in this article. Read and know now.

RBI Repo Rate Hike 2023

As per the news RBI, so going to hike the Repo rate. The bank is going to hike up the price by around 25 bps once the 2023-24 budget is announced. The repo rate by the RBI impacts the citizens in lot many ways. We have discussed the same below.

|

Important Links |

The RBI, as you are aware, is responsible for maintaining the financial stability of the nation. The repo rate is also known as the short-term lending rate, which the bank borrows from RBI in case they are short of money is increasing. This will thus impact the interest rate of savings, mortgages and loans.

RBI Repo Rate History

There has been a drastic change in the repo rate of the Reserve Bank of India in the past years. We have provided the data in a tabulated form. Those who are unaware shall keep reading in order to learn about it more.

| Effective Date | Repo Rate | %Change |

| 7 Dec 2022 | 6.25% | 0.35% |

| 30 Sep 2022 | 5.90% | 0.5% |

| 5 Aug 2022 | 5.40% | 0.5% |

| 8 June 2022 | 4.90% | 0.5% |

| May 2022 | 4.40% | 0.4% |

| 09 Oct 2020 | 4.00% | 0.00% |

| 06 Aug 2020 | 4.00% | 0.00% |

| 22 May 2020 | 4.00% | 0.40% |

| 27 Mar 2020 | 4.40% | 0.75% |

| 6 Feb 2020 | 5.15% | 0.25% |

| 07 Aug 2019 | 5.40% | 0.35% |

| 06 Jun 2019 | 5.75% | 0.25% |

| 04 Apr 2019 | 6.00% | 0.25% |

| 07 Feb 2019 | 6.25% | 0.25% |

| 01 Aug 2018 | 6.50% | 0.25% |

| 06 Jun 2018 | 6.25% | 0.25% |

| 02 Aug 2017 | 6.00% | 0.25% |

| 04 Oct 2016 | 6.25% | 0.25% |

| 05 Apr 2016 | 6.50% | 0.25% |

| 29 Sep 2015 | 6.75% | 0.50% |

| 02 Jun2015 | 7.25% | 0.25% |

| 04 Mar2015 | 7.50% | 0.25% |

| 15 Jan 2015 | 7.75% | 0.25% |

| 28 Jan 2014 | 8.00% | -0.25% |

| 29 Oct 2013 | 7.75% | -0.25% |

| 20 Sep 2013 | 7.50% | -0.25% |

| 03 May 2013 | 7.25% | -0.50% |

| 17 Mar 2011 | 6.75% | -0.25% |

| 25 Jan 2011 | 6.50% | -0.25% |

| 02 Nov 2010 | 6.25% | -0.25% |

| 16 Sep 2010 | 6.00% | -0.25% |

| 27 Jul 2010 | 5.75% | -0.25% |

| 02 Jul 2010 | 5.50% | -0.25% |

| 20 Apr 2010 | 5.25% | -0.25% |

| 19 Mar 2010 | 5.00% | -0.25% |

| 21 Apr 2009 | 4.75% | 0.25% |

| 05 Mar 2009 | 5.00% | 0.50% |

| 05 Jan 2009 | 5.50% | 1.00% |

| 08 Dec 2008 | 6.50% | 1.00% |

| 03 Nov 2008 | 7.50% | 0.50% |

| 20 Oct 2008 | 8.00% | 1.00% |

| 30 Jul 2008 | 9.00% | -0.50% |

| 25 Jun 2008 | 8.50% | -0.50% |

| 12 Jun 2008 | 8.00% | -0.25% |

| 30 Mar 2007 | 7.75% | -0.25% |

| 31 Jan 2007 | 7.50% | -0.25% |

| 30 Oct 2006 | 7.25% | -0.25% |

| 25 Jul 2006 | 7.00% | -0.50% |

| 24 Jan 2006 | 6.50% | -0.25% |

| 26 Oct 2005 | 6.25% | 00.00 |

Generally, if the Central bank of India wants to put more cash in circulation, then the Reserve Bank of India will lower the repo rate. With the increase per the data, the case would be the opposite.

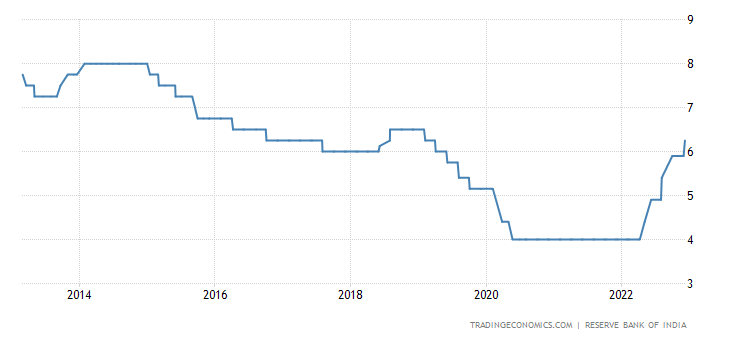

RBI Repo Rate Graph

The graph below will help you better understand the increase in the repo rate in the last ten years.

We have gathered the information to help you out. If you have any queries, then you can ask in the comment section.

- Global health Limited IPO

- DCX Systems Limited IPO

- Bikaji Foods IPO GMP

- Sarkari Result 2022

- Sarkari Naukri 2022

- Free Job Alert 2022

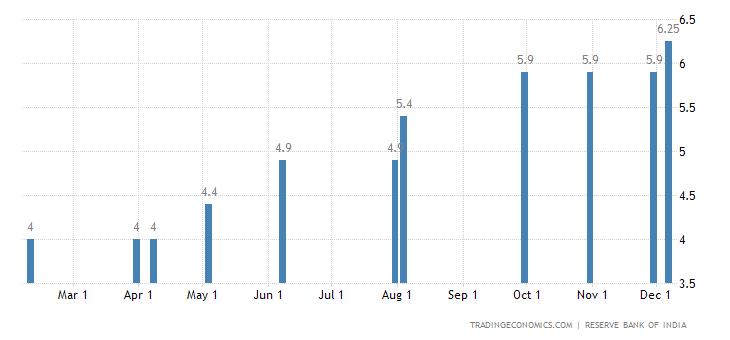

RBI Repo Rate Chart

The chart below shows the data for one year. We can see the increase, which is quite consistent monthly. The RBI is called the Banker’s bank as it facilitates financial help to the banks.

This overall increased the inflation in the nation. In Dec, we can see the Repo rate was hiked by seven by the MPC. However, the reserve repo rate remains as it is, 3.35%.

RBI Repo Rate Hike Impact

It is to be noted that the Reserve Bank of India has increased the Repo rate four times in the current financial year.

- It is going to affect other aspects such as EMIs, Fixed Deposits, Savings, Consumer spending, etc.

- It is going to impact the overall economic growth as the consumer will switch to buying goods and services more irregularly, which will affect the demand.

- As the demand falls, the growth will be impacted as well.

- This will have a negative impact on our economy.

- The commoner will have to tackle their finance cautiously in order to balance their expenses and income.

Apart from the above-listed factors, RBI is responsible for a lot may tasks. Its decision impact the life of a commoner in more than one way.

The budget of India for the financial year 2023-24 is going to be presented shortly. The mass, especially the youth, should learn about it and know the economic situation of the country and policies that have been developed for the improvement of the same.

Keep visiting MPHP.in and be aware of the latest news and related details.

We share all the updates about trending anime and web shows and cover news of politics, sports, automobiles, technology and finance as well.

Click here to go back to the first page.